Does AI-Powered Search Truly Threaten Fortress Google?

This is the question many people in the industry have been asking and trying to answer since ChatGPT appeared, like Athena fully grown from the head of Zeus, in late November 2022. Almost immediately there were numerous predictions that Google would be shunted aside by AI alternatives – probably best exemplified by Gmail creator Paul Puchheit's tweet below.

Google may be only a year or two away from total disruption. AI will eliminate the Search Engine Result Page, which is where they make most of their money.

— Paul Buchheit (@paultoo) December 1, 2022

Even if they catch up on AI, they can't fully deploy it without destroying the most valuable part of their business! https://t.co/jtq25LXdkj

Statements like this quickly turned out not to be true. We're now 19 months from ChatGPT's public launch and, so far, Google hasn't been impacted in any meaningful way, although there's widespread dissatisfaction and indications of pent up demand for Google alternatives.

For its part, Google clearly has taken the AI threat very seriously and responded with a kind of "code red" mentality, which triggered a hasty internal reorg, layoffs and major push to deploy generative AI across products.

Google unveiled its "experimental" search generative experience (SGE) in May 2023. A year later, SGE was rebranded as "AI Overviews" and released to the general public – to considerable industry consternation, scrutiny and ridicule (for high profile AI mistakes). AI Overviews have subsequently been scaled back and appear roughly 80% less often (see, 1, 2).

This may be a reaction to "bad PR" or an effort to address the underlying hallucination problem or both. Regardless, Google is probably feeling less pressure to feature AI Overviews given that it doesn't appear to have suffered too many user defections. Yet there is evidence that some users are shifting to AI or social media for search and business discovery because of frustration with Google and perceptions of declining search quality.

Let's look at some recent survey data.

Search Frustration, GenZ Defections

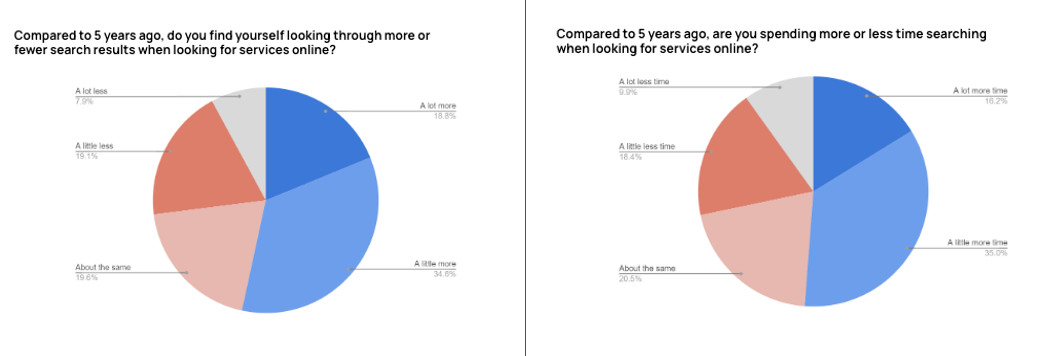

A 2024 survey from Scorpion suggests that users have grown more frustrated with search. According to the poll of 1,000 US adults, 79% said they look through more search results to find information than in the past. And 51% said finding relevant and desired results is now taking longer, which makes sense if you're looking through more links and pages. Nearly half (46%) of respondents said that they also sometimes question the "credibility" what they're seeing – suggesting that Google is less trusted today.

Searchers also express some frustration about the amount of information they must now "filter" in search results. There are more ads, more content types, modules and features than in the past: snippets, local packs, image blocks, product blocks, video, secondary search modules (e.g., People Also Ask), forums and so on. It requires more concentration and discrimination to navigate and separate useful from mediocre content and spam – with lots of clicking back and forth. In other words, search has become less efficient.

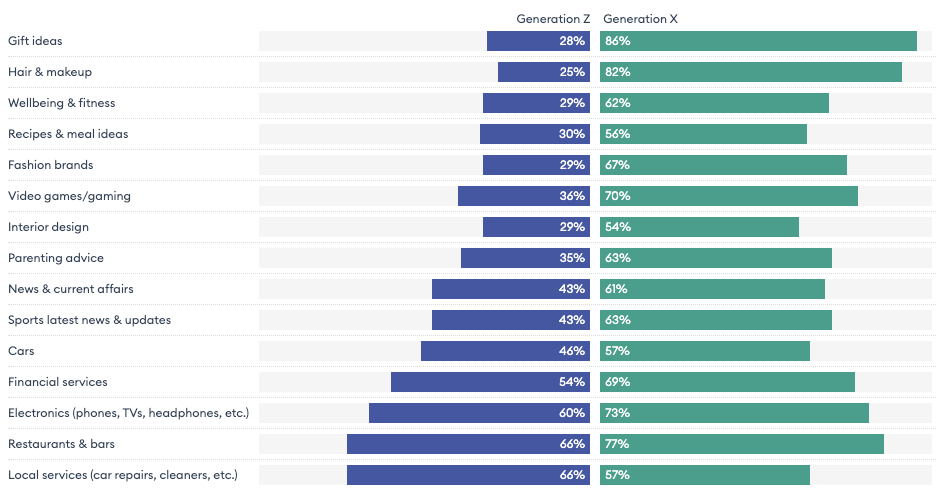

For similar reasons, many younger users have "defected" to social media to find information they would previously have searched for on Google.

Speaking at a tech conference two years ago, before the introduction of ChatGPT, Google SVP Prabhakar Raghavan said, "In our studies, something like almost 40% of young people, when they’re looking for a place for lunch, they don’t go to Google Maps or Search ... They go to TikTok or Instagram." There's a longer discussion here, but one reason for this shift is that younger users believe they're getting real recommendations or advice from real people on social media.

Social media has its ethics and disclosure problems, but there are real people talking about seemingly real experiences, which feels more immediate, "authentic" and trustworthy than most of what appears in search results.

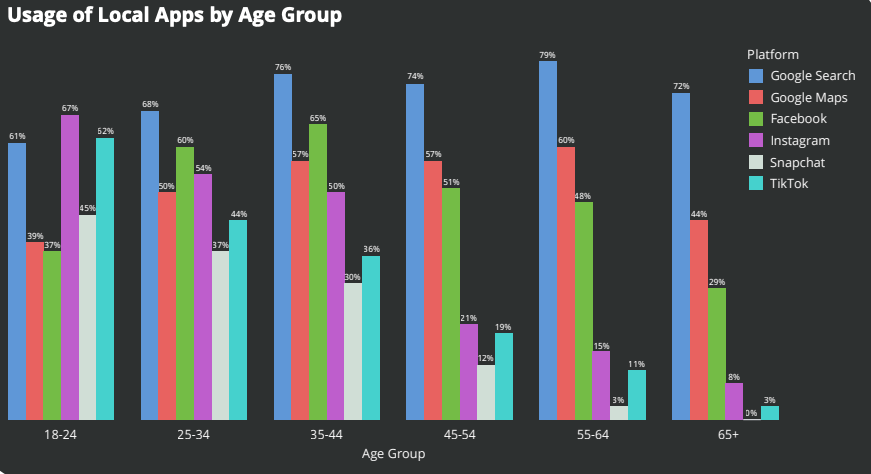

A survey from SOCi earlier this year asked specifically about how people were finding local business information. The question was, "Which smartphone apps or websites have you used in the last 30 days to look up information about local businesses?" Google Search and Google Maps were dominant overall but when segmented by age, the results are very different. Those in the 18 - 24 age group used Instagram (67%), TikTok (62%) and Google (61%) in that order. And the trend away from search among this group had accelerated in the past year.

A separate 2024 survey from Forbes Advisor also suggests a trend away from Google search for younger users. The relevant finding is: "Young people are increasingly using social apps, TikTok and Instagram in particular, for business discovery purposes." The survey of 2,000 adults determined that "there is a 25% decline in using Google for search between Generation Z and Generation X."

The SOCi and Forbes data weren't about AI, but they illustrate demand for and active use of alternatives to Google to discover information that once would have been unquestionably found on Google.

Heavy AI Users Search Less

The first consumer study, to our knowledge, to directly address the topic of this article is from Tinuiti. In June the company polled 1,000 US adults about their awareness, perceptions and usage of AI. ChatGPT was the most widely used AI tool by about a 2:1 margin. Google Gemini was second. However, a separate survey by investment firm Jeffries found that Google was the company most "associated with" AI.

According to the Tinuiti study, 40% of respondents had seen an AI Overview. And 48% of that group said that it improved Google search results, while 46% said it didn't have a meaningful impact (31%) or that it made Google results worse (15%). Those who believed it improved search results may have been reacting to the immediate availability of an "answer," as opposed to having to scan and click multiple results.

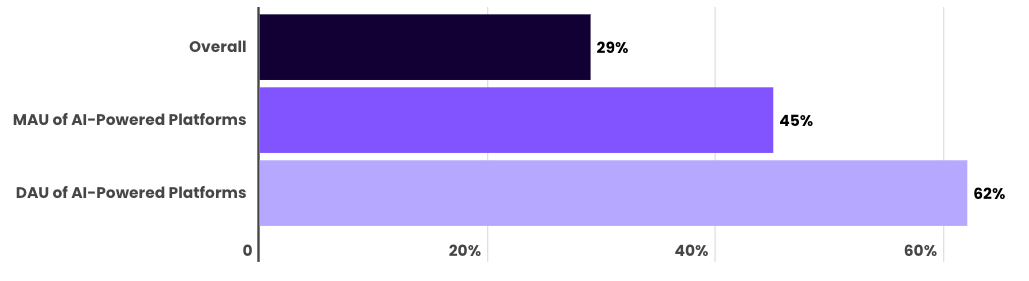

When asked whether AI usage had caused them to use traditional search less, 29% of respondents said it had. For those using AI at least monthly, 45% said they were relying on search less but the number jumped to 62% for daily users of AI tools.

This appears to confirm a good deal of anecdotal evidence, including our own personal experiences, that at least some tasks previously given to Google shift to AI. This is especially true for heavier AI users and, we suspect, for so-called "informational queries," which comprise the bulk of search volume.

What the Traffic Data Show

There's frequently a difference between how people respond in surveys and what they actually do in practice. The variance may be smaller or larger, depending on the question and context. This is not to discredit any of the above, but merely to point out that one must be cautious about drawing too many firm conclusions from surveys alone.

Looking at market share and traffic data, Bank of America analysts concluded that Google has recently increased its global search market share to 91%, while ChatGPT traffic reportedly decreased. However, the ChatGPT traffic analysis seems to be contradicted by SimilarWeb:

- June traffic for ChatGPT will be up about 96% year-over-year (YoY), comparing chatgpt.com with the website’s previous home at chat.openai.com, according to a preliminary estimate from Similarweb. In the US, the increase is 135.8% YoY and 5.55% month-over-month (MoM).

- Daily active users of the ChatGPT mobile app are also up about 13% MoM in June to 3.2 million, based on estimates for the US. Active users have been trending higher all year. Many of the new features in OpenAI’s GPT-4o algorithm related to voice and video input are coming to the app first, which will be likely to drive further increases in mobile app engagement.

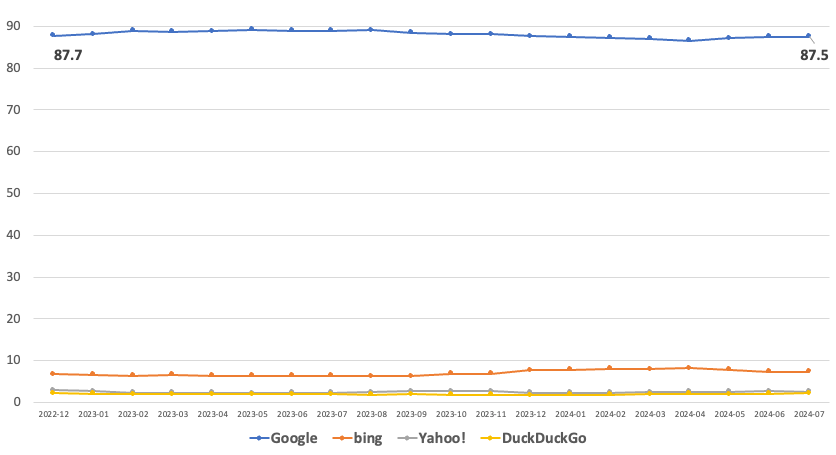

Google's search market share in the US seems to have been stable (~87.5%) since the introduction of ChatGPT. And search volume data from Datos appears to show that Google hasn't lost share in the US or EU and that searches per person are growing, and in May "were at historic highs."

Where Does This 'Net Out'?

On the one hand there is the widely held industry perception that Google is declining in utility, combined with the survey data (above) showing growing user frustration and increasing use of search alternatives (i.e., social media and AI) – at least among some populations. But on the other hand, the traffic data seem to directly contradict that "narrative." Google's grip on search appears as powerful as ever.

It's difficult to reconcile these these two sets of findings. But I don't think we can entirely discount the surveys, as some people have suggested. If they're not 100% reflective of current behavior, they may be a leading indicator of future behavior, at least in terms of people's desire and openness to alternatives.

Among the people we know who have become heavy AI users, including us, there definitely has been a decline in Google usage. Extrapolating from the Tinuiti survey data, there may be as many as 40 million people who, to some degree, are now less inclined to use Google or using it less often because of AI. But we should still be cautious about generalizing to entire populations.

AI (and social) substitution may still be too small to register. Or it may not be showing up if Google users are in fact doing more searches. Ironically per-user search volume increases may be partly because Google's not delivering satisfactory results as quickly as it once did and it takes more attempts to find what you're looking for. And any search erosion may not be showing up in market share numbers because the same people are still using Google, though perhaps less frequently in some cases.

It's also the case that even the heaviest of AI users haven't abandoned Google. The "Google habit" is deeply ingrained and AI isn't a good tool when looking for certain categories information, local or products for example. With a couple of competitive exceptions (e.g., Amazon), Google will still "own" navigational, commercial and transactional queries for the foreseeable future, even if it loses a percentage of informational searches.

To really capture mainstream adoption, ChatGPT, Perplexity and other AI providers and would-be search alternatives must instill confidence that the information they're generating is accurate and trustworthy. This remains a major concern for a majority of users (see, e.g., Pew, Scorpion) and it remains to be seen whether that hurdle can be overcome.

The Future of Search

Microsoft today is a more valuable company than during its desktop monopolistic heyday in the 1990s – despite being "disrupted" by Google and Apple. So any predictions about Google's near-term demise at the hands of OpenAI or another AI platform are aggressively premature and more likely naive.

Still, OpenAI has already achieved something Google has openly aspired to for two decades: building "the Star Trek computer" – a machine you could simply speak to and get information. This more or less describes interacting with ChatGPT-4o. The Google Assistant (or Alexa and Siri) don't currently come close, though they may eventually catch up.

It's impossible to interact with ChatGPT or its closest rivals and not feel like you're experiencing the future – of search or a successor to the current search experience. Then there's the topic of autonomous agents. It's a safe bet that search in five or 10 years looks and feels much less like Google today than something closer to ChatGPT – or something not yet in focus.

The future of search is coming. AI and other factors are forcing its evolution. Google is trying to thread the needle and deliver just enough of the future without destroying its ad revenue juggernaut. Last year the company generated just under $250 billion from advertising, about 75% of total revenue.

I used ChatGPT to look that up.