Google Ad Share Falls, AI Bubble, Social Media Wins Again

This is issue number two of Dialog: Exchange or "DX" if you prefer. We're still figuring out the right mix of elements. We'd love your feedback if you have time.

Google's (Ad) Share to Fall <50%

While there's considerable evidence that some number of people have moved beyond exclusive reliance on Google for search (including for local), the company's market share dominance has seemingly not been impacted. In North America Google's share of the search market was roughly 88% in November 2022, when ChatGPT launched. Today it's the same or even slightly higher. In Europe, Google's share was about 92% two years ago; today it's 90.4%. (ChatGPT announced in August that its weekly users had doubled to 200 million in less than a year.)

So while Google's position in consumer search appears fairly stable and secure, in the immediate future, the company seemingly faces intensifying competition for paid-search spending. According to the Wall Street Journal, "Google’s share of the U.S. search ad market is expected to drop below 50% next year for the first time in over a decade," citing an eMarketer forecast. The article discusses the rise of Amazon and TikTok search ads. It also includes long-time rivals Microsoft and Apple. And Perplexity is in there for good measure.

While the headline (drops below 50%) is very provocative, there's considerable speculation and ultimately not much news. Perplexity's consumer traffic is de minimis vs. Google – ad spending will be "experimental" until that changes. Apple and Microsoft search revenues are largely flat, as are "others" (see chart above). Amazon is the one company growing in a meaningful way. (Google has been investing heavily in product search to retain/claw back e-commerce ad spending.) And so far TikTok search ads aren't stealing budgets from Google.

In 2023, Google's paid search revenue was approximately $175 billion. That represents roughly 57% of Google's total revenue of just over $307 billion. Even though they may decline from a market share perspective, you can bet Google's real ad revenues will continue to grow – the question investors want to understand is "how much?"

New & Noteworthy

- Microsoft's Copilot AI vision is not AI enhanced search but a more expansive "an AI companion" for everyone.

- Google's NotebookLM's "deep dive conversations" podcast feature has gone viral. It's more impressive so far than Gemini itself.

- Google last week formally rolled out "AI Organized Pages," which may have a more dramatic impact on search results than AI Overviews.

- Apple Intelligence is coming to iPhones October 28. Reviews have been mixed so far (see, e.g., NYT).

- Nvidia introduces a new open-source LLM that will compete directly with ChatGPT, Gemini and Meta.

- TikTok launches AI-supported Smart+ performance marketing taking on Meta and Google P-Max.

- FTC goes after AI claims and vendors, including (review) writing tool Rytr.

- AI Bubble? Here's a worthy podcast interview with Brett Taylor, formerly of Google and Salesforce, talking about the AI bubble, AI's ultimately transformative impact and the future of AI agents.

- SaaS disruption: Jason Lemkin unpacks the risks to traditional SaaS companies from AI, echoing our theory.

- Not 80%, economist argues AI can actually do only 5% of jobs and says we're in a bubble.

Data & Discovery

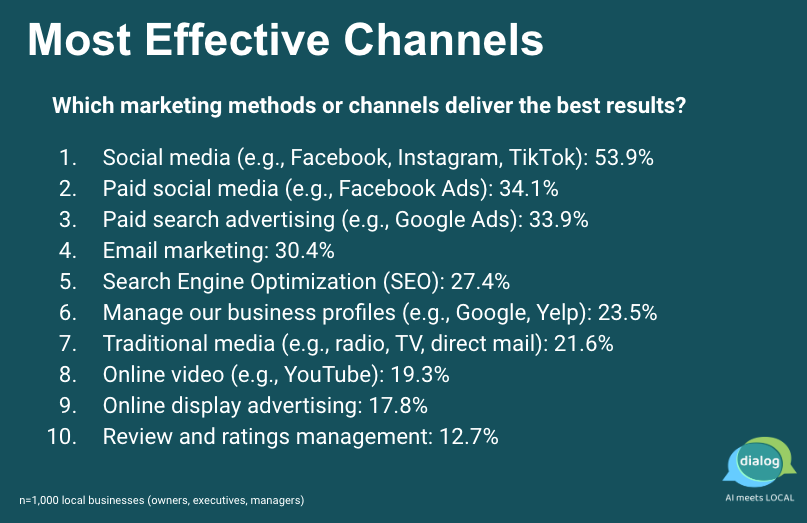

Dialog's small business survey, earlier this year, found that social media was the dominant marketing channel used by local marketers. (This is echoed in other third party data.) Local SEO and reputation management lagged far behind both in terms of usage and perceived effectiveness, which we don't agree with, but ...

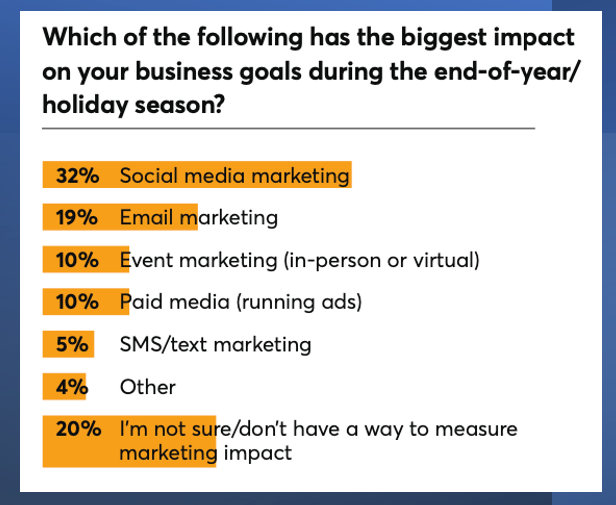

Constant Contact in partnership with Ascend2 recently released findings from a new multi-national small business and consumer survey entitled Small Business Now: How SMBs are Navigating the Economy Ahead of the Busy Holiday Season. The survey polled 1,600 SMBs and roughly 3,000 consumers in the US, Canada, UK, Australia and New Zealand. SMB headcount topped out at 250 with multiple industries represented.

The study explored Q4/holiday related marketing strategies. Both local businesses and consumers agreed that discounts were the most effective promotional tool. However, in terms of channels, social media was seen as most impactful, followed by email, event marketing and ads (undefined in the report).

This generally agrees with what we found (except for events, which could have a stronger impact during the holiday shopping season). Our discussion of channels was more granular that this; here we don't get a breakout of business profile management, paid search or SEO, and so on. Interestingly, only 36% of international respondents (average) said "positive reviews" would encourage them to make a purchase from an SMB during the holidays. Pricing, product uniqueness, inventory availability were all cited as more influential. Reviews tend to be the number one or two influence on most consumer purchase decisions generally.

The "so what?" here is the way that social media and email have become and remained the top two marketing tools that SMBs use consistently. Why? They're not complex and they can be executed on a DIY basis. Indeed, the majority of smaller SMBs tend to do marketing in house – for better or worse.

ICYMI: Dialog

Recent Dialog content and data you might have missed:

- Is AI Responsible for Recent Ad Industry Job Losses? – despite the growth of ad spending and bullish forecasts, the industry has posted job losses in successive quarters.

- Does AI-Powered Search Truly Threaten Fortress Google? – there's considerable evidence that Google is vulnerable but that hasn't yet shown up in traffic data.

Funny | Weird | Other

- Meet Cara a relatively new anti-AI social media platform advocating for artists. The site has seen massive growth as part of an AI backlash among artists and visual creatives.

- Google's "baby peacock" AI-generated images problem is a kind of harbinger of doom for the internet.